Semiconductor Weekly News(5.7-5.12)| It is rumored that TSMC will raise prices again, with a range of 3%...

2023-05-15

1/ It is rumored that TSMC will raise prices again, with a range of 3%

According to the DigiTimes report, IC design companies said that the boom in demand for semiconductors has passed, and upstream and downstream hastily cut prices in order to quickly reduce inventory. Only TSMC remained unchanged. Recently, it has been reported again that TSMC will raise prices again in the second half of the year or the first half of 2024, starting from 3% in response to the contribution of individual processes and customer order replenishment.

According to the report, although TSMC is facing a crisis of 10 major customers cutting orders and a sharp drop in capacity utilization, the foundry quotation is still firm and does not give a chance to bargain. By the first quarter of 2023, TSMC's wafer inventory has reached a new high, and the capacity utilization rate has also declined significantly. The production capacity of 7/6 nanometers has dropped by less than 50% from the same period in 2022. The production capacity of 5 nanometers that is in short supply in 2022 will also loosen. 8-inch The factory's mature process orders have also shrunk. The popular 28nm process is estimated to have an average capacity utilization rate of about 70~75% in the first half.

TSMC internally believes that after semiconductor inventory adjustments, the economy will eventually recover, and a new wave of growth is expected to usher in the second half of 2023 to 2024. Not long ago, in a law conference, TSMC executives said that the market is "bottoming out" this quarter, and it is estimated that the overall destocking will not end until the second half of the year, and that demand for smartphones and PCs is expected to remain "weak" throughout 2023. ". In terms of TSMC, in the second half of the year, the mass production of 3nm will drive demand to pick up.

Regarding the news of the price increase, TSMC stated that it would not respond to market rumors.

2/ UMC's 8-inch capacity utilization in the second quarter was lower than expected

According to Taiwan media Economic Daily, the legal entity estimates that UMC’s wafer shipments in the second quarter will be equivalent to the previous quarter, with a capacity utilization rate of 70%; the US dollar ASP of the overall product will maintain the previous quarter’s level, and the gross profit margin will be about 35%.

It is reported that UMC’s financial report released recently shows that the company’s revenue in April was NT$18.461 billion, an annual decrease of 19% and a monthly increase of 4.37%. Revenue has risen for two consecutive months. Industry insiders estimate that the average monthly revenue of UMC in May and June will be approximately NT$17.8-17.9 billion, a drop of approximately 3% to 4% compared to April.

Previously, UMC expected wafer shipments in the second quarter to be the same as the previous quarter, and the gross profit margin was estimated to be 34% to 36%. It is estimated that the production capacity in this quarter will increase by 4.12% quarterly and 3.88% annually; the capacity utilization rate will fall between 71% and 73%. Between them, they are also comparable to the first season. In the second quarter, the demand for consumption, communications and vehicles is expected to be stable, and driven by OLED driver ICs, digital TVs and WiFi, the 22nm and 28nm process conditions should improve in the next few months.

3/ Western Digital Corp sees weak fourth quarter on slower recovery for memory chip

According to Reuters, memory chip company Western Digital recently announced its financial report showing third-quarter operating income of $2.8 billion, exceeding expectations of $2.7 billion. But Western Digital forecast fourth-quarter revenue below Wall Street expectations and a larger loss, suggesting memory chip demand will take longer to recover as cloud spending is cut.

Western Digital said it was exploring splitting the flash and hard drive businesses after Elliott Management pushed for them to be split. In the third quarter, revenue in those two divisions fell about 42% and 30%, respectively, from a year earlier, Western Digital said. In addition, in the third quarter, Western Digital's cloud revenue fell 32% to $1.21 billion.

The memory industry, which was the first to experience an oversupply of chips last year, has been hit hard by falling chip prices due to the combined impact of falling demand for electronics and oversupply, the report said. While memory chip makers have been cutting production to ease a supply glut and support memory chip prices, a weak global economic outlook has made recovery out of reach.

4/ NVIDIA urgently places an order with TSMC to book advanced packaging capacity

According to a report from the Electronic Times, a person familiar with the advanced packaging and testing supply chain revealed that Nvidia's demand for AI top specification chips for ChatGPT and related applications has significantly increased in the future. It urgently increased its booking of CoWoS advanced packaging capacity to TSMC, which is approximately 10000 more chips than originally estimated for the whole year.

According to the report, due to the need for advanced packaging production capacity to be planned and scheduled, TSMC's CoWoS monthly production capacity is only about 8000-9000 pieces. If emergency scheduled production capacity is added, TSMC's average monthly CoWoS production capacity will increase by about 1000-2000 pieces, and the CoWoS production capacity will continue to be tight at that time.

5/ KDI: The semiconductor industry boom bottomed out in the second and third quarters

According to Yonhap News Agency, the latest report of KDI, the South Korea Development Institute, pointed out that most equipment that requires semiconductors has a replacement cycle. It is expected that the semiconductor industry will bottom out in the second and third quarters of this year, but it is too early to expect a full recovery in the market. A research committee member of the institute also said that the demand for computers and smart phones will gradually increase, and the semiconductor industry may start to recover in the middle of next year. However, due to the great uncertainty of the global economy, it is difficult to predict the follow-up development.

In addition, the recent downturn in the semiconductor industry is mainly due to poor chip sales. In the first quarter of this year, global system chip sales fell by 11.1% year-on-year, and memory chip sales fell by 56.3%. The severe damage to exports also has a great impact on domestic demand. According to analysis, if semiconductor exports decrease by 10%, South Korea's GDP will shrink by 0.78%. If semiconductor prices fall by 20%, GDP will decrease by 0.15%.

6/ China's auto exports increased by 120.3% year-on-year in the first four months of the General Administration of Customs

According to data from the General Administration of Customs on May 9, China's export of mechanical and electrical products in the first four months increased by 10.5%, of which automobiles increased by 120.3% and mobile phones decreased by 3.2%.

In the first four months, China exported 4.44 trillion yuan of mechanical and electrical products, an increase of 10.5%, accounting for 57.9% of the total export value. Among them, the export of automobiles was 204.53 billion yuan, an increase of 120.3%; the export of mobile phones was 282.95 billion yuan, a decrease of 3.2%

It is worth noting that the number of mobile phone exports fell for the second consecutive year over the same period. In the first four months, the export of mobile phones was 230 million units, a decrease of 13.2%. In the same period last year, China exported 270 million mobile phones, a decrease of 14.2%; exports were 292.48 billion yuan, a slight increase of 0.1%.

In the first four months, 1.494 million automobiles were exported, an increase of 76.5%. In response to this trend, Cui Dongshu, secretary-general of the Passenger Passenger Association, believes that: "New energy vehicles are the core growth point of China's auto exports, which has changed the dependence on some poor and irregular countries such as Asia and Africa. Export the passive situation."

7/ Apple and Samsung continue to dominate the global tablet market

According to the "India Express" report, the US International Data Corporation IDC pointed out in a report that Apple and Samsung will lead the global tablet market in the first quarter of 2023, with the two companies accounting for nearly 58% of the market.

The data shows that in the first quarter of 2023, global tablet shipments fell by 19.1% year-on-year to 30.7 million units. Apple shipped 10.8 million tablets in the quarter, accounting for 35.2 percent, followed by Samsung at 23.1 percent with 7.1 million shipments, and Huawei with a 6.6 percent share (2 million units). three.

Anuroopa Nataraj, senior research analyst at IDC Mobile and Consumer Devices Tracker, said: "Tablet PC vendors entered the Q1 of 2023 cautiously. As expected, as the macro environment remained uncertain throughout the first quarter, business and The number of consumers is very low.”

In addition, the report expects tablet shipments to be low in the first half of 2023, with suppliers focusing on clearing inventory before launching new models.

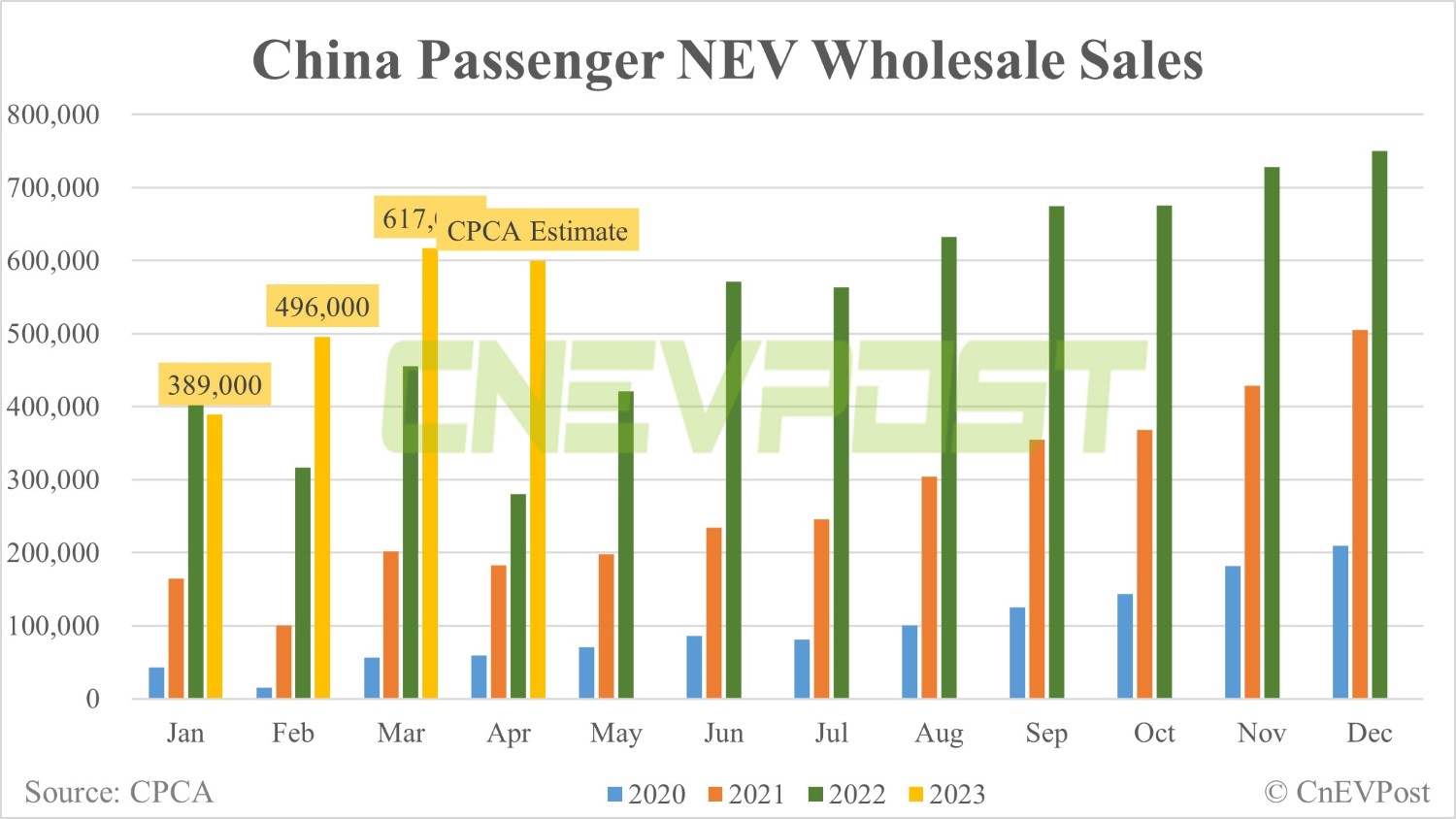

8/ China's NEV wholesale in April at about 600,000 units, CPCA estimates show

China's wholesale sales of new energy passenger vehicles are expected to be 600,000 units in April, basically unchanged from March and up 114 percent year-on-year, the China Passenger Car Association (CPCA) said in a report today.

Among them, Tesla's wholesale sales in China in April were 75,842 vehicles. It is estimated that from January to April, the national new energy wholesale of passenger car manufacturers will reach 2.1 million, a year-on-year increase of 43%.

In addition, the Passenger Federation expects that domestic sales of passenger vehicles in the narrow sense will be 23.5 million this year, and sales of new energy passenger vehicles will be 8.5 million. The annual penetration rate of new energy vehicles is expected to reach 36%. The current operating status is basically consistent with the forecast.